Stay ahead of your client's expectations with outcome based delivery...

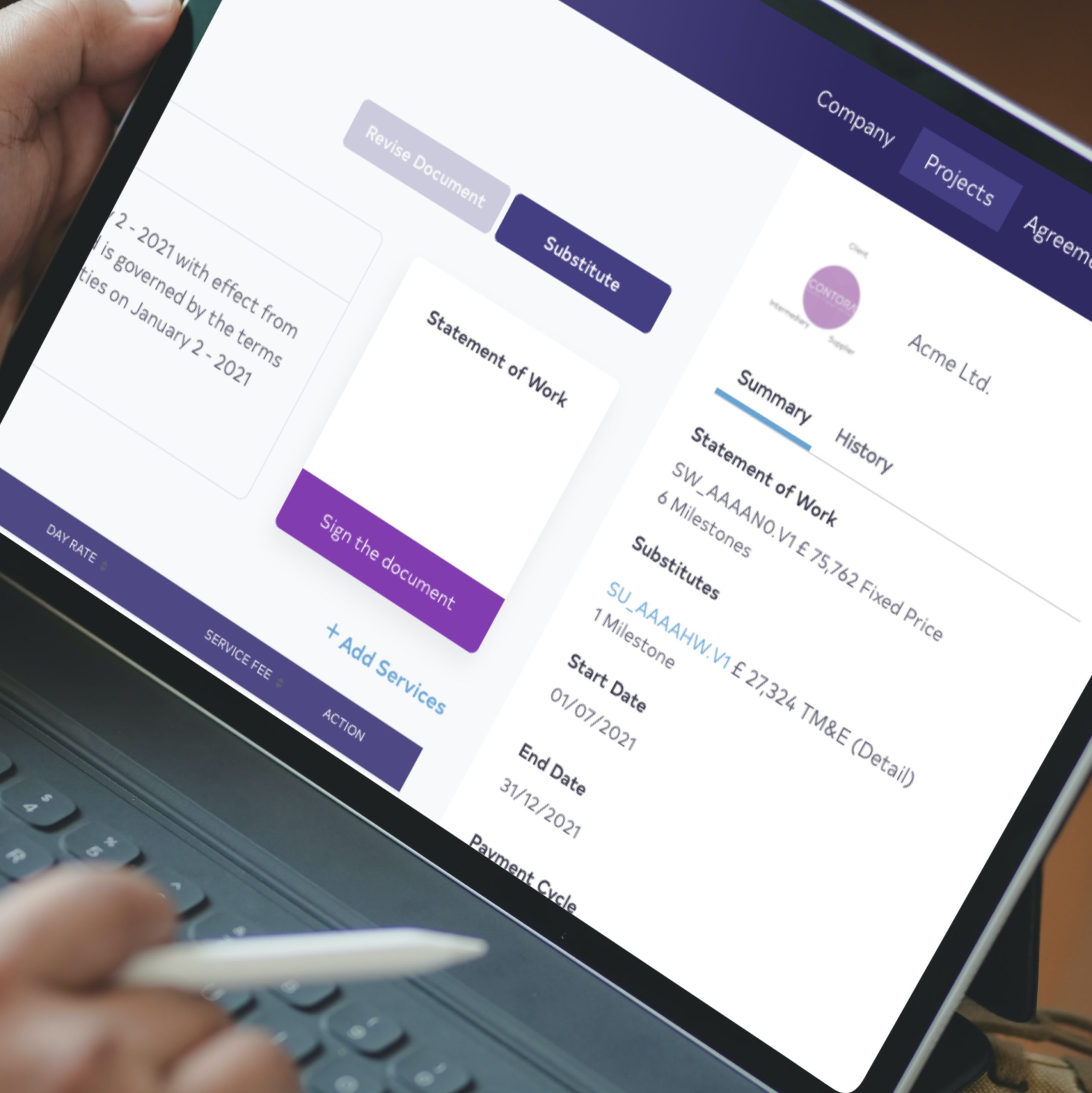

With complete transparency at project, milestone and deliverable level, it’s never been easier to manage client expectations with Statements of Work that drive outcome based services.

Your platform, your service...

The contora framework allows you to manage and grow your services, at scale, without the traditional overhead of managing paper-based or word template Statements of Work.

Create SoWs in half the time with a workflow that builds a collaborative partnership with your clients and supports compliance with off-payroll legislation

Create SoWs in half the time with a workflow that builds a collaborative partnership with your clients and supports compliance with off-payroll legislation

- Build Statements of Work, FAST

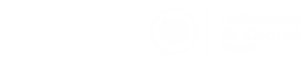

- Create, review, modify, e-sign & track

- One Click Substitution

- Aligned ways of working

Centralised COMPLIANCE

Contora provides an all-party, common way of working for managing statements of work.

Business Growth

Contora scales easily, keeps admin costs low and doesn't eat into your service margins.

Contract approval

Contora allows suppliers and clients to create, track and approve off-payroll compliant statements of work.

Contora makes your contracts and engagements visible, interactive and collaborative rather than paper-based, inert and difficult to manage.

Still not sure if Contora is right for you?

Our ROI calculator provides you with a clear insight into how much you could save with Contora based on 7 simple questions on your current SOW practices.

Want to see the Contora difference?

Create your first Work Package completely free and without obligation.

Our no-obligation offer provides you with access to everything Contora has to offer and helps you try all the benefits first-hand.

Simply book a discovery call and we’ll get you set up in an instant.